U.S. Inflation Hits 7% First Time In 40 Years And What It Means To Bitcoin (BTC)

Inflation in the United States just reached 7%, the highest level in 40 years.

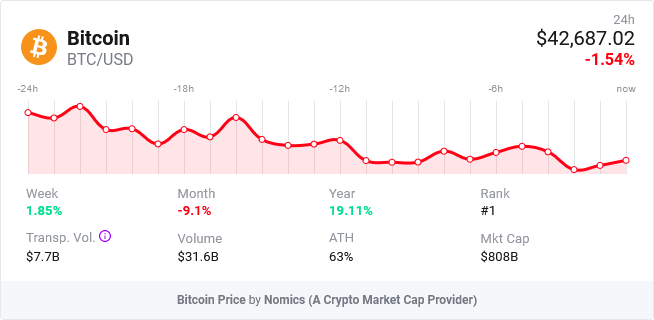

The recent Consumer Price Index (CPI) data boosted Bitcoin and Ethereum prices by more than 3% and 4.5 percent, respectively, bringing their unit values above $43,000 and $3,300.

While historical trends imply that the $11 trillion gold market is the best bet for a secure hedge against dollar depreciation, the crypto market’s reaction to current inflation suggests that many people are willing to resort to cryptocurrencies this time.

This is especially true for many people in the medium to upper income brackets who want to preserve their cash and near-liquid investments from depreciation.

With over 160 percent value rise in 2021, Bitcoin, Ethereum, and other cryptocurrencies have a higher chance of being a viable alternative to fiat value loss for the typical American investor.

According to the most recent Consumer Price Index chart, energy (33.3%) is the leading driver of inflation, followed by housing (4.1%), food costs (>6%), cars, and medical care services (>2%).

Since Biden cut off domestic exploration in favor of importation, the United States has been experiencing increasing gasoline scarcity.

The Federal Reserve System of the United States announced in November that it expects a further increase and has already planned procedures to contain such a spike.

The hike in interest rates is one of the most important of these initiatives, as it will limit increasing borrowing throughout the time.